Cap Table Management Software for Transfer Agents

compliantly manage compliant securities

offer issuers a seamless path to secondary trading with streamlined ATS-transfer solution

pay dividends with the click of a button

optimize existing transfer agent services with CustodyWare technology

Is your transfer agency equipped to support the next wave of capital formation?

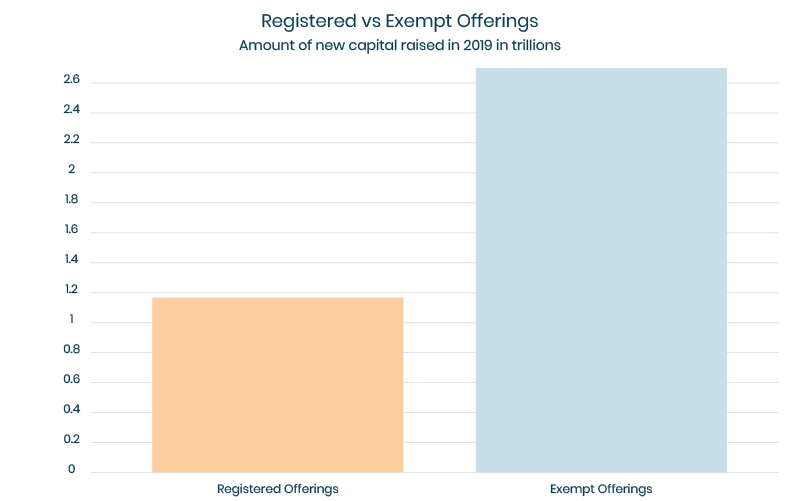

On an annual basis, the amount of capital raised in exempt offerings is twice the size of registered offerings. Regulation D is the most frequently used pathway to raise capital from investors and works well for companies that have access to accredited investors.

Forward-thinking transfer agents are leveraging CustodyWare’s cap table management software to meet issuer and investor demand for high-tech, high-touch solutions.

Source: Office of the Advocate for Small Business Capital Formation

Update your legacy cap table management systems with one integrated solution

1.INTEGRATE

CustodyWare seamlessly integrates into your existing TA technology or as a standalone hosted web portal.

2.PROGRAM COMPLIANCE

Integrated KYC/AML compliance checks on investors with an audit trail that checks have been performed.

3.EXPAND SERVICES

Support the influx of new Reg A+, Reg D, & Reg CF issuers conducting exempt securities offerings.

4.PROTECT INVESTORS

Protect investors and issuers with transparent and immutable storage of shareholder records.

Features

Securities Issuers

|

Reg A+ or S-1 Securities Offerings |

Reg CF or Reg D Securities Offerings |

Good Control Location |

|---|---|---|

Engaging a transfer agent is mandated by the SEC for issuers conducting S-1 registrations or securities offerings under Regulation A+, unless 12(g) exempt. |

Efficient transfer agent operations are critical to the successful completion of secondary trades. Reg D and Reg CF issuers will be looking to transfer agents who offer a streamlined solution. |

Immutable proof of the holder’s identity is maintained by CustodyWare while the actual identity documentation is securely stored by the transfer agent in a regulatory compliant storage media pursuant to SEC Regulation S-P. |

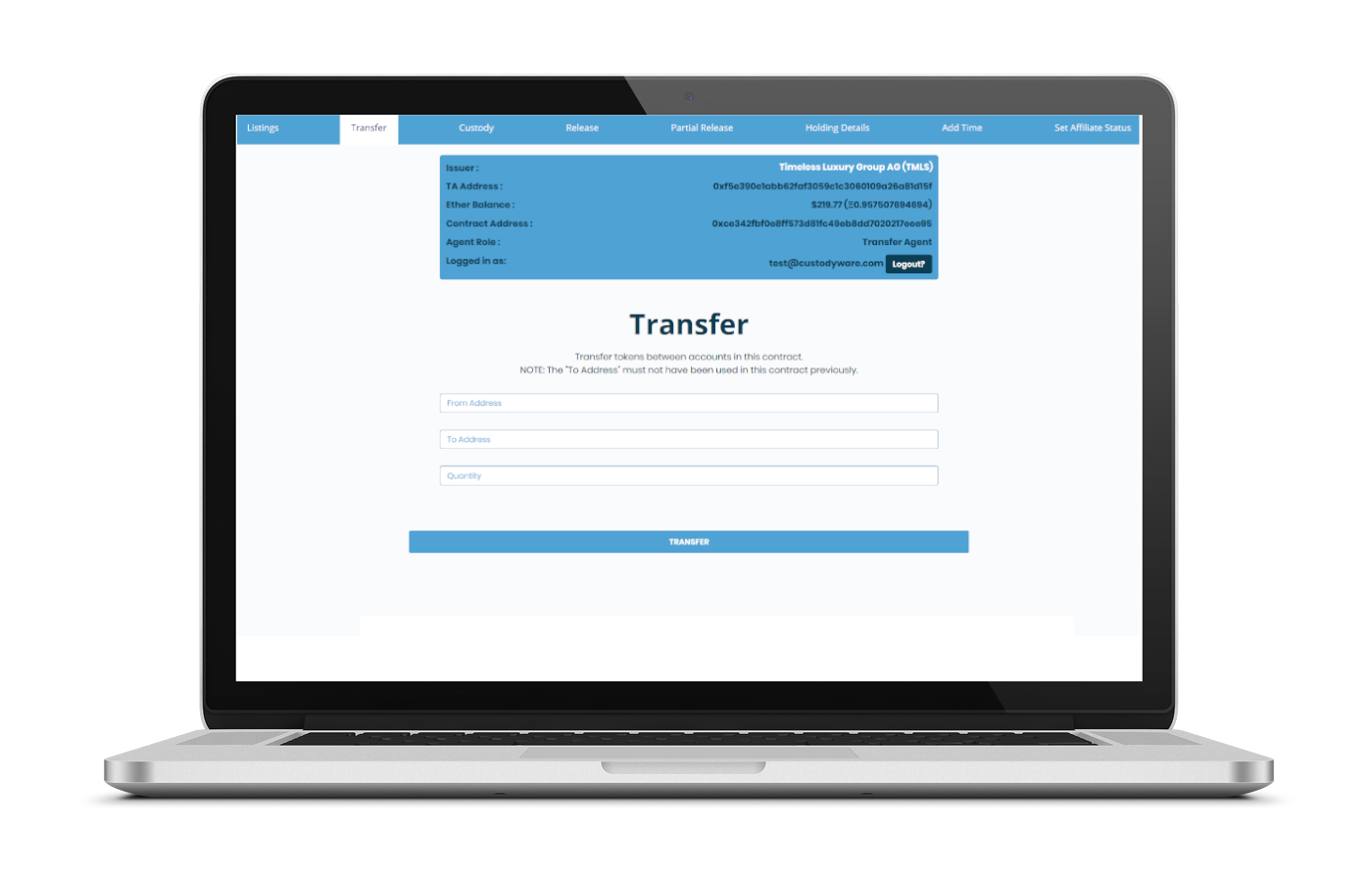

How it works

The issuer engages an SEC registered transfer agent in the CustodyWare community to manage investors’ shareholdings.

The electronic assets remain the property of the investor, and the investor has complete control of movement, however, appointing a transfer agent enables safe and transparent management of the assets.

Utilizing a transfer agent sets up an issuer’s securities for increased liquidity potential as such securities can be moved to “street-name” for secondary trading on an SEC-regulated ATS.

On instruction from an investor, transfer agents can execute transfers and releases to secondary trading.

CustodyWare-powered transfer agents can maintain post-offering up-to-date shareholder listings, reports, distributions, proxy information, etc. with the cap table management software.

Join our transfer agent community

How will you manage the new wave of capital formation?

To request more information or if you have any questions you may also reach us at horizon@custodyware.com.

Error submitting your message. Are all fields valid and filled in?

Message Successfully Sent!

Secondary Trading

Secondary Trading Securities Issuance

Securities Issuance Know Your Customer ‘KYC’

Know Your Customer ‘KYC’ Anti-Money Laundering ‘AML’

Anti-Money Laundering ‘AML’ Cap Table Management

Cap Table Management Data Management Platform

Data Management Platform